FlowBank Review 2024

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail CFD accounts lose money You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FlowBank’s recent bankruptcy proceedings and lack of regulatory licenses bring down its overall Trust Score to a "Do Not Trust" level.

Note: As of 13 June 2024, Swiss regulator FINMA has opened bankruptcy proceedings against FlowBank SA, stating that the bank no longer has the minimum capital required for its business operations.

Overall Rating

Minimum Deposit

Trust Score

Recent news

June 2024: As of 13 June 2024, Swiss regulator FINMA has opened bankruptcy proceedings against FlowBank SA, stating that the bank no longer has the minimum capital required for its business operations. You can find out more by reading FINMA's official press release.

Pros and Cons

Pros

- Extensive Tradeable Symbols: FlowBank offered an impressive array of over 400,000 symbols.

- Robust Platform Options: Included popular platforms like MetaTrader 4 and 5 and a proprietary platform.

- Copy Trading: Enabled traders to mirror the strategies of experienced traders.

Cons

- Limited Educational Resources: Lacked advanced educational videos, which might be a setback for advanced learners.

- Geographic Restrictions: Not authorised by ASIC or FCA, and not MiFID regulated, limiting its accessibility for some international traders.

- Beginner Education Rating: Received a slightly lower rating in beginner education, which could be improved.

Ratings Summary

- Investment Types - 10/10

- Commissions & Fees - 7.5/10

- Trading platforms - 7.5/10

- Research - 7.0/10

- Mobile Apps - 8.0/10

- Education - 7.0/10

- Overall - 7.7/10

FlowBank Bankruptcy

Bankruptcy proceedings have been opened against FlowBank, what happens now?

FINMA, the Swiss financial markets regulator, has initiated bankruptcy proceedings against FlowBank SA due to its breach of regulatory capital requirements. As a result, trading has been halted and no new transactions can be initiated. A list of claims will be assessed for every FlowBank client to determine their eligibility as claimants.

All creditors – including customers who held bank accounts at FlowBank – will have to register their claims with the liquidator. For any questions, FlowBank clients should contact the official liquidator, Walder Wyss AG (WalderWyss.com), based in Switzerland.

Will I get all of my money back from FlowBank?

All FlowBank banking client deposits are insured up to 100,000 CHF, thanks to the mandatory deposit insurance in place for Swiss banks via esisuisse.

According to the regulator's press release, clients with more than 100,000 CHF on deposit at FlowBank will be included in the claims and paid out in whole or in part as proceedings move forward, depending on available assets. Amounts in excess of 100,000 CHF become part of a third class of bankruptcy claims.

Creditors receive priority in a bankruptcy proceeding. If you hold a deposit at FlowBank, you can expect to be contacted by the liquidator, Walder Wyss AG, to discuss payment options afforded to you as part of the liquidation process.

When will I receive my money from FlowBank?

According to FINMA, up to 100,000 CHF will be paid out, per customer, within seven days of providing payment instructions to the liquidator. If you are a FlowBank customer, it would be prudent to contact the liquidator immediately to begin the withdrawal process.

What will happen to securities held at FlowBank?

The manner in which securities are held at FlowBank (either in its name as owner, or in the name of underlying client accounts) will determine whether securities will be exempt from the bankruptcy process or liquidated to become part of the bankruptcy. It is expected to take several weeks to determine how the shares are held in terms of ownership. In the US, for example, it is customary for many brokers to hold the shares in the brokers own name, also known as the “street” name. US brokers only hold securities in the customers name if a customer requests to have share certificates mailed to them.

Who can I contact at FlowBank if I have any questions?

The FlowBank website now displays a static landing page related to this bankruptcy case, directing clients to contact the liquidator at [ project-liquidateurfb@walderwyss.com ].

Can I trust FlowBank?

FlowBank’s recent bankruptcy proceedings and lack of regulatory licenses bring down its overall Trust Score to a "Do Not Trust" level. This trust data is credited to the forex industry research website ForexBrokers.com.

FlowBank is currently licensed and/or authorised by the following regulatory bodies:

- Tier-1 Regulators - None

- Tier-2 Regulators - None

- Tier-3 Regulators - None

- Tier-4 Regulators - None

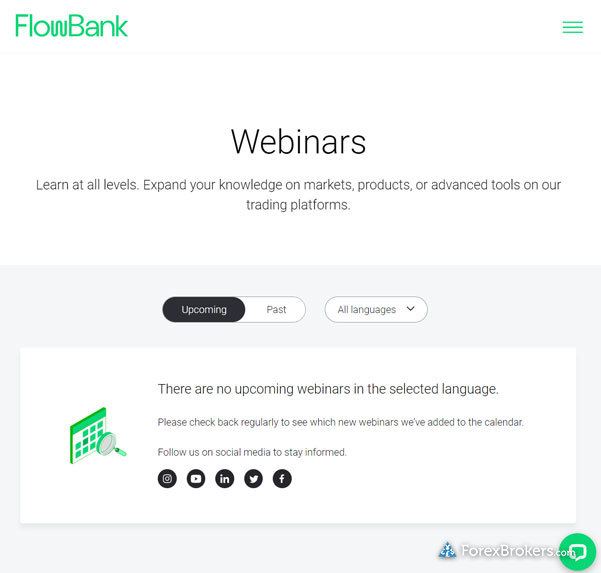

Is FlowBank good for beginners?

FlowBank is a decent choice for beginners, providing beginner education videos and general forex or CFD education, though its overall educational offerings are rated slightly lower than others, indicating there is room for improvement.

| Feature |

FlowBank FlowBank

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | No |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | No |

FlowBank commissions and fees summary

FlowBank's commissions and fees are viewed as competitive within the industry. While the average spread cost for the EUR/USD pair is not disclosed, its general fee structure, including the availability of active trader discounts, makes it an attractive option for both new and experienced traders.

| Feature |

FlowBank FlowBank

|

|---|---|

| Minimum Deposit | $0 |

| Average Spread EUR/USD - Mini | N/A |

| Average Spread EUR/USD - Standard | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | Yes |

FlowBank trading platforms and tools

Did you know? Trading platforms comparison

Of the 60+ brokers reviewed on BrokerNotes, 64% offer a proprietary platform, 100% offer a web platform, 91% offer a desktop platform, 11% offer cTrader, 14% offer ZuluTrade, 81% offer MetaTrader 4, and 64% offer MetaTrader 5.

FlowBank provides a robust selection of trading platforms and tools that are highly recommended. It offers both MetaTrader 4 and 5, alongside its proprietary platform, enhancing trading experience.

Trading platforms offered: MetaTrader 4, MetaTrader 5, and a proprietary platform.

Trading tools: Provides a comprehensive suite of trading tools through its platforms.

Copy trading: Available, enabling users to replicate the trades of experienced traders.

| Feature |

FlowBank FlowBank

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

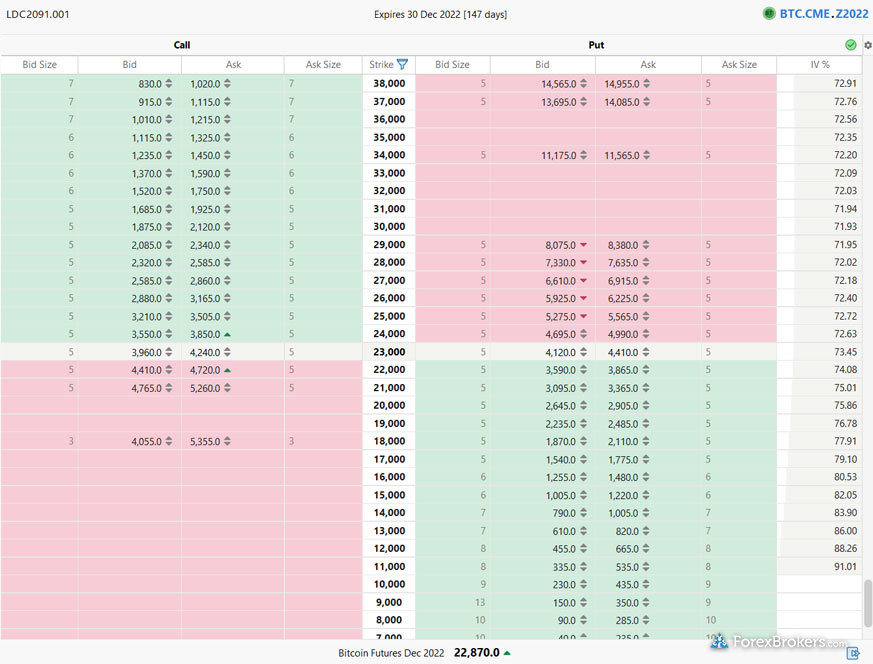

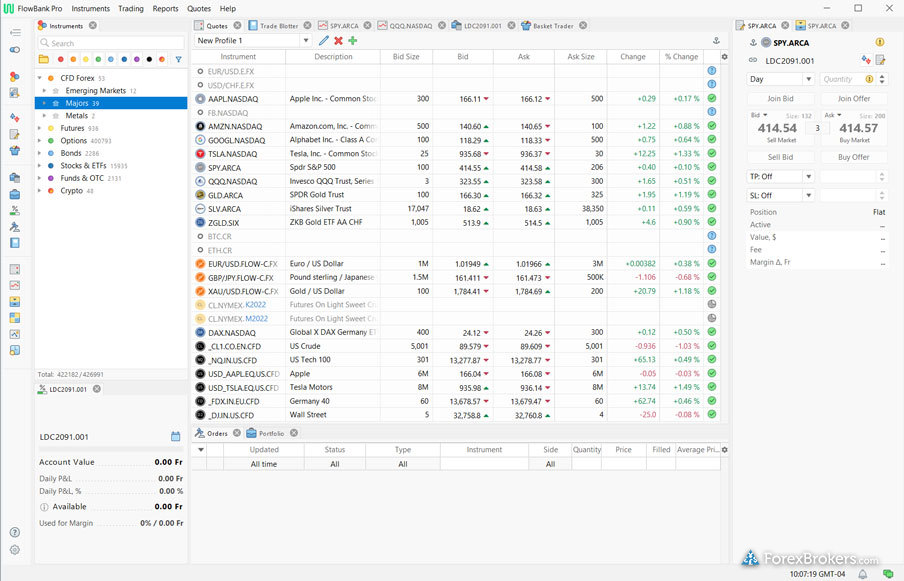

FlowBank trading platform screenshots

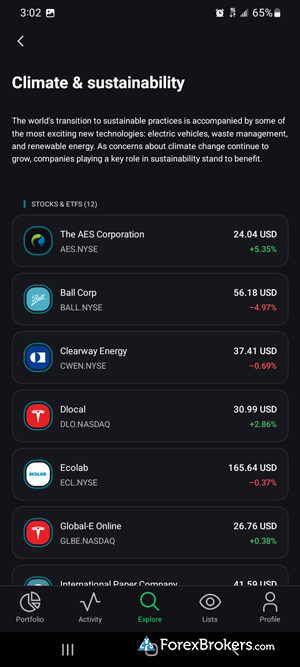

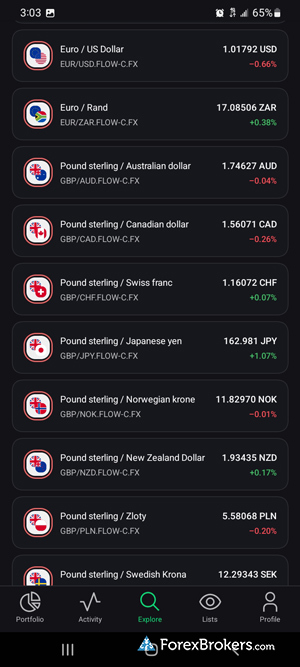

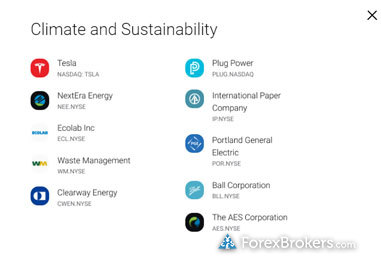

Mobile trading apps at FlowBank

FlowBank provides efficient mobile trading apps, enhancing trading flexibility and accessibility.

| Feature |

FlowBank FlowBank

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Economic Calendar | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Watchlist | Yes |

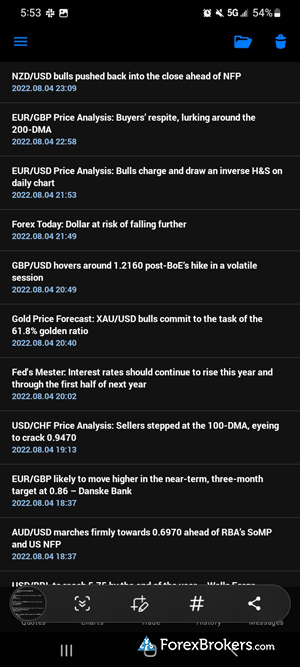

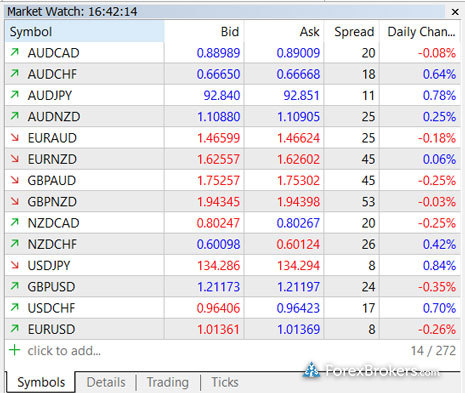

FlowBank mobile app screenshots

How do I open an account with FlowBank?

To open an account with FlowBank, follow these simple steps:

- Visit the FlowBank website.

- Navigate to the account opening page.

- Provide the required personal information.

- Complete the verification process.

- Fund your account to start trading.

What can I trade at FlowBank?

At FlowBank, traders have access to a diverse range of assets, with 52 forex pairs and an extraordinary number of over 400,000 tradeable symbols, far exceeding the industry average.

| Feature |

FlowBank FlowBank

|

|---|---|

| Tradeable Symbols (Total) | 408600 |

| Forex Pairs (Total) | 52 |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Spread Betting | No |

FlowBank research screenshots

Account funding at FlowBank

FlowBank supports various funding methods, including bank wires and credit cards, although it does not support some popular eWallets like Neteller and PayPal.

| Feature |

FlowBank FlowBank

|

|---|---|

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

| PayPal (Deposit/Withdraw) | No |

| Skrill (Deposit/Withdraw) | No |

| Neteller (Deposit/Withdraw) | No |

About FlowBank

FlowBank was founded in 2020, emerging as a new player in the financial services industry. It has quickly established a significant presence with its vast range of tradeable symbols and versatile trading platforms. Despite its recent entry, FlowBank has earned a trustworthy reputation among traders, partly due to its Swiss banking license and commitment to offering a broad suite of trading tools and resources.

Popular Forex Guides

- Compare Forex and CFD Brokers

- Best MT4 Brokers of 2024

- Best NinjaTrader Brokers of 2024

- Best HFT Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best Zero Spread Forex Brokers of 2024

- Best Depth of Market Forex Brokers of 2024

- Best Mac Forex Trading Platforms of 2024

- Best PayPal Forex Brokers of 2024

- Best Institutional Forex Brokers of 2024

- Best Forex Apps of 2024

- Best Fixed Spread Brokers of 2024

- Best Low Slippage Forex Brokers of 2024

- Best Forex Brokers of 2024

- Best CFD Trading Platforms of 2024

More Forex Guides

- Best Silver Trading Platforms of 2024

- Best Futures Brokers of 2024

- Best Autochartist Forex Brokers of 2024

- Best Forex Micro Accounts

- Best MT5 Brokers of 2024

- Best Islamic Forex Brokers of 2024

- Best Scalping Forex Brokers of 2024

- Best Dow Jones Brokers of 2024

- Best Gold Trading Platforms of 2024

- Best Spread Betting Brokers of 2024

- Best Forex Demo Accounts

- Best Bitcoin Brokers of 2024

Popular Forex Reviews

- IG Review

- Interactive Brokers Review

- FOREX.com Review

- IG Review

- IC Markets Review

- OctaFX Review

- All Broker Reviews

Methodology

At BrokerNotes.co, our data-driven online broker reviews are based on our extensive testing of brokers, platforms, products, technologies, and third-party trading tools. Our product testing extends to the quality and availability of educational content, market research resources, and the accessibility and capabilities of mobile platforms and trading apps. We also dive into each broker’s trading costs, such as VIP rebates, inactivity fees, custody fees, bid/ask spreads, and other fee-based data points.

Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go. We test mobile apps and products using iPhones running iOS 17 and Samsung devices running Android OS 14.

Note: The online brokers on our site provide the ability to trade forex in one or more ways, such as non-deliverable spot forex (i.e., rolling spot contracts), contracts for difference (CFD), or other derivatives such as futures. The availability of specific markets or features will depend on your country of residence and the broker's applicable brand or entity that services your account(s).

AI disclaimer

We use proprietary AI technology to assist in some aspects of our content production. However, our scores, ratings, and rankings of online brokers are based on our in-depth product testing and thousands of hand-collected data points. Learn more about our AI Policy and How We Test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Learn more about foreign exchange risk.