CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Copy Trading Pros and Cons

Pros

- Can be ideal for passive traders or investors who want to diversify their portfolios without having to conduct their own in-depth technical analysis.

- Beginner traders can use copy trading as a tool to learn about the investment strategies of experienced traders.

- It can eliminate the emotional bias and impulsive decision-making that can come with purely self-directed trading (Note: Copy trading is still a form of self-directed trading).

Cons

- No guarantees: Copy trading does not guarantee success or profitability in the forex market; the past performance of a signal provider does not indicate their future results. Market conditions can still change quickly and unpredictably.

- High risk: Copy trading does not eliminate the risk of losing money in the forex market. You are still exposed to market fluctuations and volatility. If the trader you are following makes a mistake, has a bad streak, or stops trading, you may suffer losses.

- Poor strategy selection: Not all traders are reliable, consistent, or suitable for your goals and preferences. You need to be careful about who you follow, and do your own research and analysis before copying their trades.

- Dependency on copy trading: Copy trading can create a reliance on other traders and hinder your personal growth as an investor.

Is copy trading legal?

The legality of copy trading is dependent on the regulations of your country or local jurisdiction. In countries where trading is strictly regulated, copy trading may be considered illegal.

In the United States, for example, copy trading is legal but subject to strict rules. Copy traders must be registered with the Securities and Exchange Commission as Registered Investment Advisers or Registered Commodity Trading Advisors. Failure to register can result in civil or criminal penalties.

travel_exploreCopy trading in the United States

Learn more about copy trading and forex trading in the U.S. by heading over to our sister site, ForexBrokers.com and checking out their guide to forex trading in the U.S.

In the European Union, copy trading is generally allowed but with restrictions that govern how it can be marketed. Copy trading platforms are required to disclose the risks involved, and traders must be given a clear indication of the performance data of the traders they are copying.

In countries with less strict regulations, copy trading may not be subject to any legal restrictions whatsoever. That said, we always recommend choosing a broker or copy trading provider that is highly regulated in reputable jurisdictions. Learn more by checking out our Trust Score page.

file_copyWant to become a signal provider?

Any trader can become a signal provider. You just need to register with a copy trading platform and make your trades available to copiers.

A brief history of copy trading in the forex market

The history of forex copy trading can be traced back to the 1990s. With the new widespread adoption of the internet, forex trading became available to the masses, and investors began to copy the trades of experts. The launch of social trading platforms like eToro and ZuluTrade in the late 2000s made it possible for traders to automatically copy the trades of other traders regardless of their experience level.

In recent years, there has been tremendous growth in the forex copy-trading industry. According to Globe Newswire, the social trading platform market size is expected to grow from $2.22 Billion in 2021 to $3.77 Billion by 2028

What is the best copy trading platform?

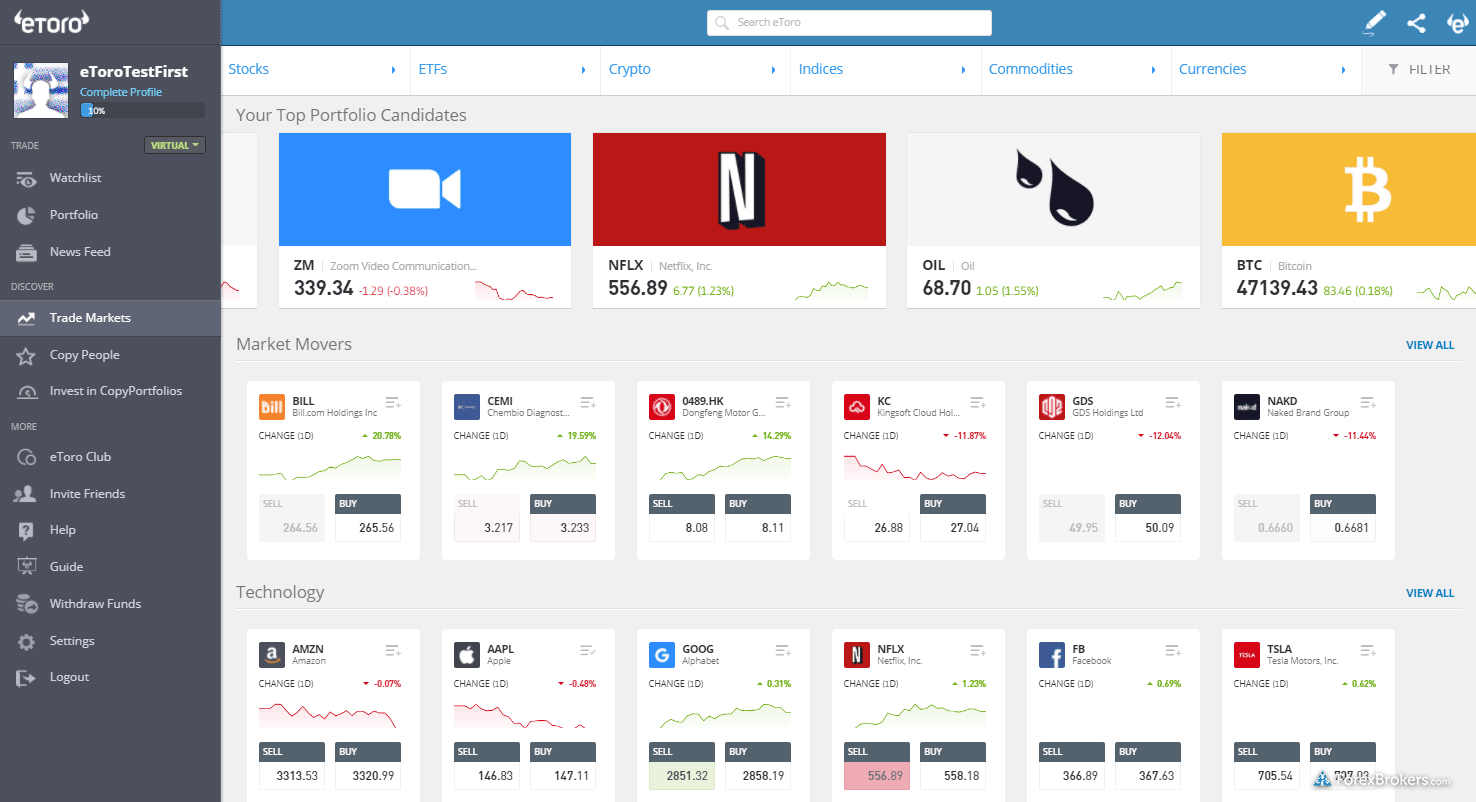

We evaluated various platforms for copy trading in 2024, and we concluded that eToro is the best broker for copy trading. eToro's copy trading platform offers a range of useful features designed to help you find traders to copy

- Risk Scores: Each trader on eToro receives a risk score from 1 to 10, indicating the level of risk associated with their portfolio. This score can help you evaluate and decide which traders to copy based on your risk tolerance.

- Copy Stop Loss: This feature allows you to set a limit on the maximum amount you are willing to lose on a copied trader. Once this limit is reached, the copy relationship automatically ends.

- CopyPortfolios: This feature bundles together a group of traders with similar investment strategies. By investing in these portfolios, you diversify your investments, which has the potential to spread your risk across multiple traders (this does not eliminate risk; forex trading – even when following a signal provider – is risky).

- Popular Investors: eToro's Popular Investor program includes experienced traders with a successful track record of trading. You can follow their trades while learning about their investment strategies.

Check out a gallery of screenshots from eToro's trading platforms, taken by our research team during our product testing.

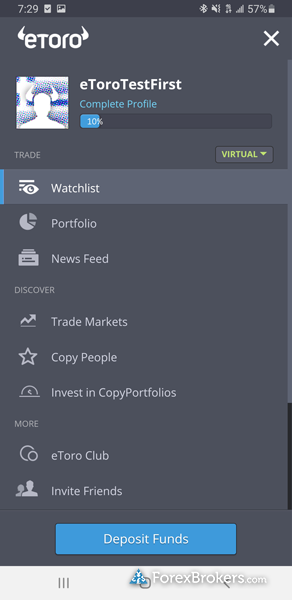

What is the best app for copy trading?

eToro has the best app for copy trading, and is a great choice for beginners as well as seasoned investors. eToro's copy trading app delivers access to thousands of investors with a wide variety of trading strategies. eToro also provides risk levels for signal providers and custom risk management settings. Simply put, eToro has made copy trading more accessible than ever.

Click through our gallery of screenshots of eToro's mobile apps, taken by our research team during our product testing.

How to get started copy trading

Copy trading allows you to follow the trades of other traders in real-time. To get started as a copy trader, choose a highly regulated forex broker that offers a copy trading platform, and then select a trader (or, "signal provider") that you'd like to follow. Factors to consider when choosing a signal provider are their historical performance, trading strategy, and risk tolerance. Customize your settings (control how much you want to allocate to each provider and how much risk you are willing to take). Once you are all set up, the signal provider's trades will be automatically replicated in your account.

How to choose a trader to copy

When choosing a trader or signal provider to copy, consider factors such as the provider's number of open positions, typical holding time for investments, preferred type of investments, risk tolerance, return rate, and how long the provider has been an active trader. It's also important to consider your own trading goals, preferences, and your personal level of risk tolerance.

To start copy trading, follow these five steps:

- Filter the selection of traders (signal providers) based on your trading goals and risk tolerance. Check out any available rankings and statistics on your copy trading platform.

- Evaluate and compare the remaining candidates and decide who to copy, (if anyone).

- Set your risk/reward parameters for each trader that you have copied, and decide whether you will copy their current open positions or only new positions moving forward.

- Once you are happy with your settings, click to copy trade the providers you have chosen.

- Check the performance of your trading account regularly. Change your settings and subscriptions as needed

Can you make money from copy trading?

Yes, you can make money by engaging in copy trading. However, you can also lose money. Your financial gains or losses will depend on the traders you choose to follow and the timing of your decisions. It's crucial to evaluate each trader's profitability before copying their trades and understand that past performance doesn't guarantee future results.

Copy trading carries risk, so it's advisable to only invest what you're prepared to lose. Begin with a modest investment and conduct thorough research before settling on a trading strategy. While copy trading isn't a shortcut to quick riches, it can aid in diversifying your portfolio when used judiciously. The best copy trading brokers will provide tools to manage your account effectively.

reportAn important note about copy trading

Copy trading isn't suitable for everyone. Your suitability for copy trading depends on your financial goals, risk tolerance, and the portion of your portfolio you're willing to dedicate to this strategy. Contrary to popular belief, copy trading is not a passive investment; copy trading is a form of self-directed trading that requires your active participation.

Is there a minimum deposit requirement for copy trading?

Minimum deposit requirements vary depending on your copy trading platform and your broker. Minimum deposits can range from $0 to as much as several hundred dollars (or the currency equivalent).

What are the fees associated with copy trading?

Copy trading fees vary, depending on the platform, the type of trader (or signal provider) you copy, and your broker. Fees associated with copy trading can include Copy Trader fees, spreads and commissions, and sometimes inactivity fees. It's important to research fees and understand them fully before signing up with any specific platform. Look for those platforms that deliver transparent fee structures, competitive spreads, and a wide range of available assets.

Conclusion

Copy trading can be a straightforward way traders for traders and investors to diversify their portfolios. However, it's essential to understand that – like all forms of trading and investing – copy trading carries risk. It's crucial to conduct thorough research and due diligence to choose the most suitable signal providers for your own trading goals. With the right strategy and approach, copy trading can be a valuable addition to your investment portfolio.

Best Copy Trading Brokers Recap

To recap, here are our top forex brokers for copy trading in 2024.

Popular Forex Guides

More Forex Guides

Popular Forex Reviews

Methodology

At BrokerNotes.co, our data-driven online broker reviews are based on our extensive testing of brokers, platforms, products, technologies, and third-party trading tools. Our product testing extends to the quality and availability of educational content, market research resources, and the accessibility and capabilities of mobile platforms and trading apps. We also dive into each broker’s trading costs, such as VIP rebates, inactivity fees, custody fees, bid/ask spreads, and other fee-based data points.

Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go. We test mobile apps and products using iPhones running iOS 17 and Samsung devices running Android OS 14.

Note: The online brokers on our site provide the ability to trade forex in one or more ways, such as non-deliverable spot forex (i.e., rolling spot contracts), contracts for difference (CFD), or other derivatives such as futures. The availability of specific markets or features will depend on your country of residence and the broker's applicable brand or entity that services your account(s).

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Learn more about foreign exchange risk.

About the Editorial Team

Founded in 2014 and acquired in 2021, BrokerNotes.co provides unbiased forex broker reviews and ratings to help traders and investors find the best broker for their needs. With over 60 brokers reviewed, our editorial team has published thousands of words of research to help our readers make informed choices.

Steven Hatzakis is the Global Director of Online Broker Research for BrokerNotes.co and ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

Joey Shadeck is the Content Strategist and Research Analyst for BrokerNotes.co and ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

John Bringans is the Managing Editor of BrokerNotes.co and ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

Saxo

Saxo

IG

IG

Interactive Brokers

Interactive Brokers

FOREX.com

FOREX.com

Charles Schwab

Charles Schwab

XTB

XTB

City Index

City Index

Capital.com

Capital.com

Swissquote

Swissquote

OANDA

OANDA

Plus500

Plus500

XM Group

XM Group

Admirals

Admirals

FP Markets

FP Markets

FxPro

FxPro

Markets.com

Markets.com

BlackBull Markets

BlackBull Markets

Fineco

Fineco

ThinkMarkets

ThinkMarkets

DooPrime

DooPrime

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

Trading 212

Trading 212

Questrade

Questrade

ActivTrades

ActivTrades

Trade Nation

Trade Nation

Moneta Markets

Moneta Markets

BDSwiss

BDSwiss

TMGM

TMGM

Eightcap

Eightcap

Spreadex

Spreadex

MultiBank

MultiBank

easyMarkets

easyMarkets

Exness

Exness

VT Markets

VT Markets

IFC Markets

IFC Markets

RoboForex

RoboForex

Octa

Octa

IronFX

IronFX

Axi

Axi

Earn

Earn

ATFX

ATFX

iFOREX

iFOREX

FXPrimus

FXPrimus

FXOpen

FXOpen

Markets4you

Markets4you

GBE brokers

GBE brokers

Alpari

Alpari

FXGT.com

FXGT.com

Xtrade

Xtrade

Libertex (Forex Club)

Libertex (Forex Club)

TopFX

TopFX

LegacyFX

LegacyFX