CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Forex broker Islamic account comparison

Understanding Islamic forex trading and its unique requirements

Islamic forex trading, also known as sharia-compliant forex or halal forex, is a specialized form of currency trading that adheres to the principles of Islamic law. In Islamic finance, the concept of riba (interest) is strictly prohibited, and this principle extends to all financial transactions, including forex trading.

Unlike conventional forex trading, which involves earning interest on overnight positions and engaging in speculative activities that may be considered gambling, Islamic forex trading follows a distinct set of strict guidelines designed to follow Sharia law.

In this guide, we'll explore the unique requirements and considerations involved in Islamic forex trading. We will delve into the key principles that govern this form of trading and discuss how traders can participate in riba-free trading while still taking advantage of the currency markets' potential for profit.

What types of trades are not allowed in Islamic accounts?

These common forex trends are not generally permitted within Islamic trading accounts:

- Riba: Interest charged on loans or deposits.

- Pledge: A signed commitment agreeing to pay back a loan within a limited time. The agent is permitted to sell the contract and recover the loan if the customer is unable to reach the specific percentage of the margin.

- Loans: Money given by an agent (bank) to the customer on some settled terms of interest.

- Short selling: Borrowing and selling an asset the trader does not own for profit.

- Trading on margin: Borrowing money from a broker to purchase assets.

- Forwards sales: Agreements to buy or sell assets at a future time at an agreed-upon price.

Key features to look for when selecting an Islamic forex broker

When selecting an Islamic forex broker, it is important to consider key features that align with the principles of Sharia. Here are some essential features to look for:

- Swap-free accounts: Islamic forex brokers offer swap-free or "Islamic" accounts that comply with Sharia principles. These accounts do not charge or pay any interest (riba) on overnight positions, ensuring compliance with Islamic finance principles.

- Transparent fees and commissions: Look for brokers that provide transparent fee structures and clearly outline their charges.

- Compliance with Sharia principles: Choose a broker that is fully compliant with Sharia principles in all aspects of their operations. This includes adhering to ethical business practices, avoiding investments in prohibited industries such as gambling or alcohol, and conducting transactions in accordance with Islamic finance guidelines.

- Ethical investment options: Some Islamic forex brokers offer additional investment options aligned with values such as socially responsible investing (SRI) or halal investment opportunities. These options allow traders to invest in companies or industries that align with their religious beliefs.

- Reputation and regulation: Ensure that the broker you choose has a strong reputation and is regulated by a reputable financial authority. This provides an added layer of security and ensures that your funds are protected. Learn more about regulation by checking out our Trust Score page.

Halal investment opportunities beyond forex trading

When it comes to exploring halal investment opportunities, many individuals focus solely on forex trading. However, it is essential to educate yourself about other sharia-compliant investment options that go beyond forex trading. This will allow you to diversify your portfolio and make informed decisions based on your financial goals and religious beliefs.

One of the most common alternative investment options for Muslims is stocks. Investing in stocks of companies that comply with Islamic principles can provide an opportunity for growth and potential dividends while adhering to halal guidelines. It is crucial to research and identify companies that operate in industries such as technology, healthcare, or renewable energy, which align with Islamic values.

Commodities trading is another avenue worth exploring for halal investments. Commodities such as gold, silver, and agricultural products can be traded in compliance with Islamic principles. By understanding the fundamentals of commodities markets and following ethical guidelines, investors can participate in this sector while ensuring their investments are halal.

To make informed decisions regarding these investment options, it is essential to educate yourself about the principles of Islamic finance and seek guidance from experts who specialize in Sharia-compliant investing. By doing so, you can navigate the world of halal investments beyond forex trading and potentially create a diversified portfolio tailored to your financial aspirations while remaining true to your religious beliefs.

What is the best forex broker for an Islamic account?

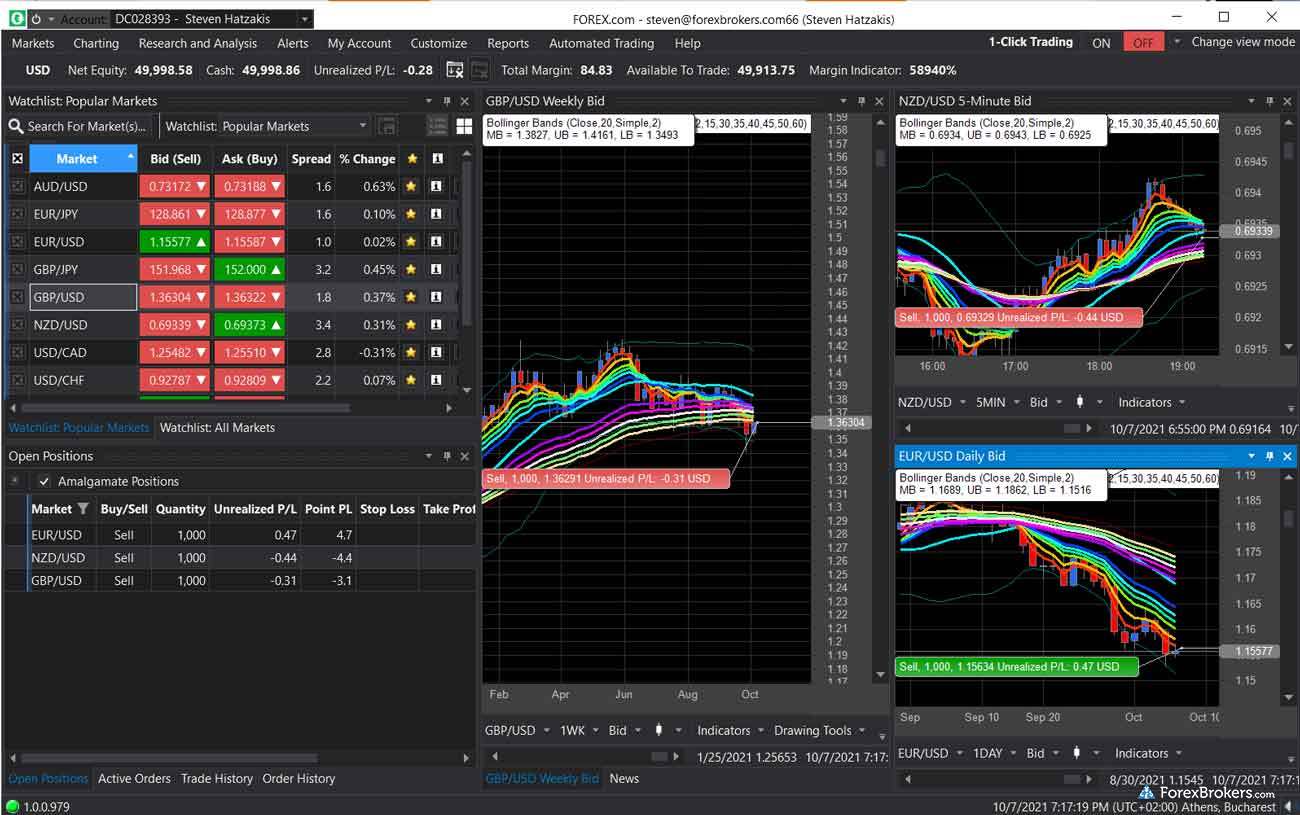

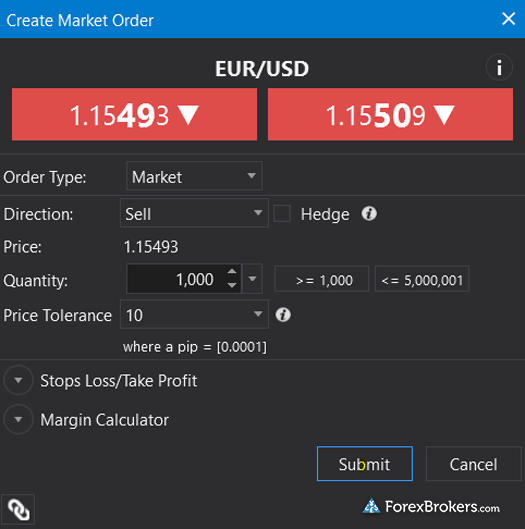

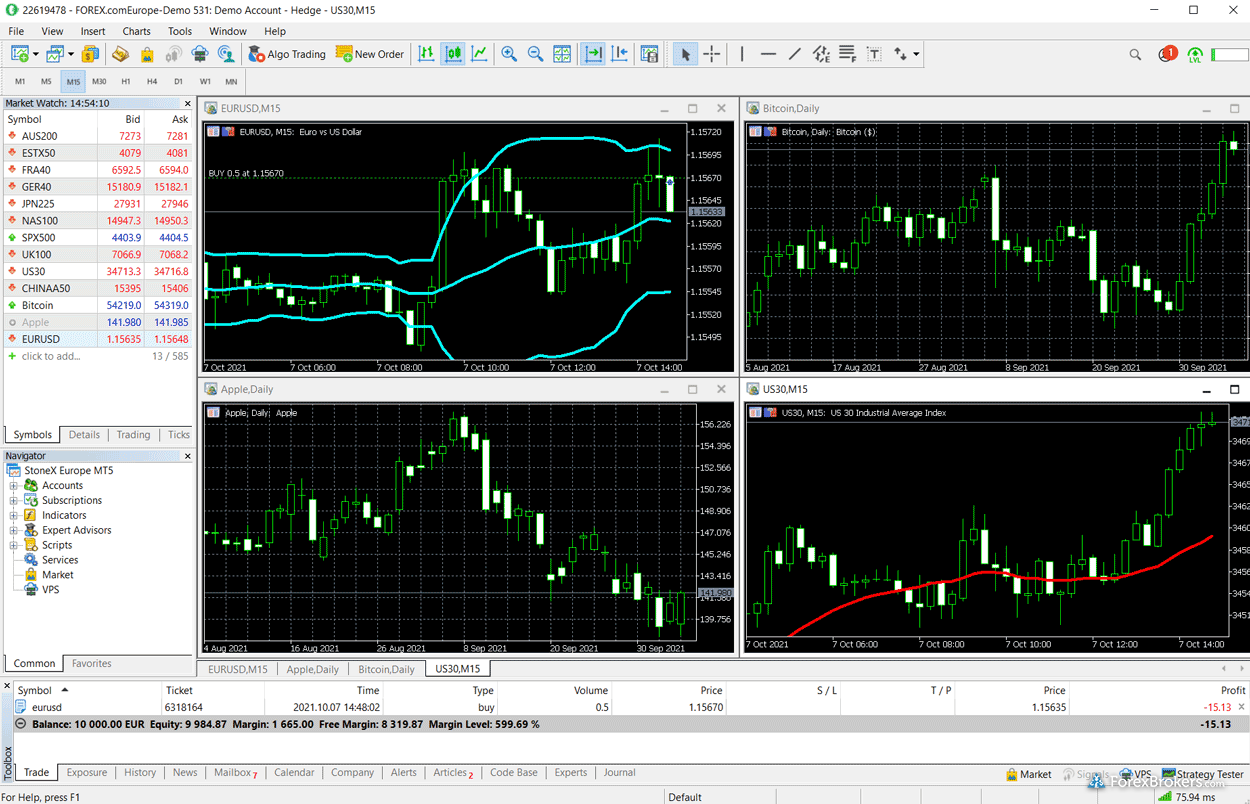

FOREX.com is the best forex broker that provides access to an Islamic trading account. FOREX.com, part of the StoneX Group, is a highly trusted brand with a long history of offering forex in the U.S. and across the globe. We love FOREX.com's flagship trading platforms for web and desktop (TradingView's powerful charting is fully integrated within the broker's web platform), and MetaTrader loyalists will appreciate that FOREX.com offers both MetaTrader 4 and MetaTrader 5. An impressive number of CFDs are available within the broker's proprietary platform (though fewer are available on MetaTrader). FOREX.com's pricing is great for active traders, but our research found that FOREX.com is slightly expensive compared to the industry average. Overall, FOREX.com is a well-balanced choice for traders of all experience levels.

FOREX.com Trading Platform Screenshots

How can I open an Islamic account?

Opening an Islamic forex account is now easier than ever. With the Islamic banking sector as growing by an average of 19.7% a year, there is now an increasing number of brokers offering Islamic forex account services. The accounts are designed in the support of all the Islamic rulings on business and investments.

BrokerNotes.co 2026 Overall Rankings

To recap, here are our top forex brokers for 2026, sorted by Overall ranking.

Popular Forex Guides

More Forex Guides

Popular Forex Reviews

Methodology

At BrokerNotes.co, our data-driven online broker reviews are based on our extensive testing of brokers, platforms, products, technologies, and third-party trading tools. Our product testing extends to the quality and availability of educational content, market research resources, and the accessibility and capabilities of mobile platforms and trading apps. We also dive into each broker’s trading costs, such as VIP rebates, inactivity fees, custody fees, bid/ask spreads, and other fee-based data points.

Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go. We test mobile apps and products using iPhones running iOS 17 and Samsung devices running Android OS 14.

Note: The online brokers on our site provide the ability to trade forex in one or more ways, such as non-deliverable spot forex (i.e., rolling spot contracts), contracts for difference (CFD), or other derivatives such as futures. The availability of specific markets or features will depend on your country of residence and the broker's applicable brand or entity that services your account(s).

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Learn more about foreign exchange risk.

About the Editorial Team

Founded in 2014 and acquired in 2021, BrokerNotes.co provides unbiased forex broker reviews and ratings to help traders and investors find the best broker for their needs. With over 60 brokers reviewed, our editorial team has published thousands of words of research to help our readers make informed choices.

Steven Hatzakis is the Global Director of Online Broker Research for BrokerNotes.co and ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

Joey Shadeck is the Content Strategist and Research Analyst for BrokerNotes.co and ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

John Bringans is the Managing Editor of BrokerNotes.co and ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

IG

IG

Interactive Brokers

Interactive Brokers

Saxo

Saxo

CMC Markets

CMC Markets

Charles Schwab

Charles Schwab

City Index

City Index

Capital.com

Capital.com

Plus500

Plus500

FXCM

FXCM

Admirals

Admirals

IC Markets

IC Markets

FxPro

FxPro

Tickmill

Tickmill

Markets.com

Markets.com

BlackBull Markets

BlackBull Markets

Fineco

Fineco

Vantage

Vantage

ThinkMarkets

ThinkMarkets

DooPrime

DooPrime

HYCM (Henyep Capital Markets)

HYCM (Henyep Capital Markets)

HFM

HFM

Trading 212

Trading 212

Questrade

Questrade

ActivTrades

ActivTrades

Trade Nation

Trade Nation

Moneta Markets

Moneta Markets

BDSwiss

BDSwiss

TMGM

TMGM

Eightcap

Eightcap

Spreadex

Spreadex

MultiBank

MultiBank

ACY Securities

ACY Securities

easyMarkets

easyMarkets

Exness

Exness

VT Markets

VT Markets

IFC Markets

IFC Markets

RoboForex

RoboForex

Octa

Octa

IronFX

IronFX

Axi

Axi

Earn

Earn

ATFX

ATFX

iFOREX

iFOREX

FXPrimus

FXPrimus

FXOpen

FXOpen

Markets4you

Markets4you

GBE brokers

GBE brokers

Alpari

Alpari

FXGT.com

FXGT.com

Xtrade

Xtrade

Libertex (Forex Club)

Libertex (Forex Club)

TopFX

TopFX

LegacyFX

LegacyFX