CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What are the best Poland forex brokers?

We’ve tested over 60 international forex brokers and created unbiased, data-driven broker ratings to show you the best forex brokers in the industry. To help you navigate the world of forex regulations and choose a broker that you can trust, our expert research team has built a proprietary database containing over 100 global regulatory licenses and jurisdictions; that research determines each broker's individual Trust Score. Check out our top picks for the best Poland forex brokers:

Winner: FOREX.com

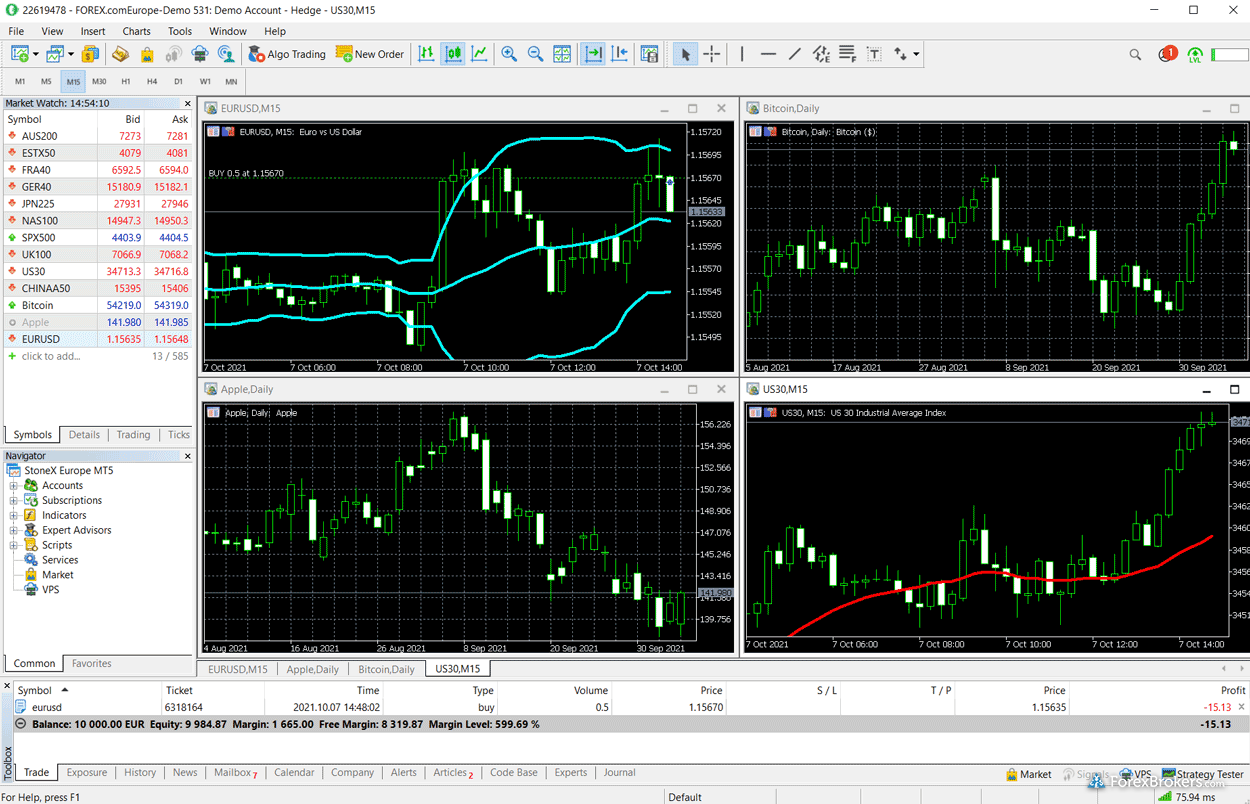

FOREX.com, part of the StoneX Group, is a highly trusted brand with a long history of offering forex in the U.S. and across the globe. We love FOREX.com's flagship trading platforms for web and desktop (TradingView's powerful charting is fully integrated within the broker's web platform), and MetaTrader loyalists will appreciate that FOREX.com offers both MetaTrader 4 and MetaTrader 5. An impressive number of CFDs are available within the broker's proprietary platform (though fewer are available on MetaTrader). FOREX.com's pricing is great for active traders, but our research found that FOREX.com is slightly expensive compared to the industry average. Overall, FOREX.com is a well-balanced choice for traders of all experience levels.

FOREX.com Features

- Overall rating - 9.5/10

- Trust Score - 99

- Tradeable symbols - 5500

- Minimum deposit - $100

Runner Up: XTB

XTB is a highly trusted brand that holds licenses multiple global regulatory jurisdictions, earning it a Trust Score rating of 96. XTB's proprietary xStation 5 platform delivers a rich selection of trading tools and great usability. XTB provides access to CFDs for a wide range of asset classes, including multiple cryptocurrencies. Beginner forex traders will appreciate XTB's excellent educational content and the hundreds of lessons that are available via its Trading Academy.

XTB Features

- Overall rating - 9.2/10

- Trust Score - 96

- Tradeable symbols - 10900

- Minimum deposit - $0

Podium Finisher: eToro

Best known for its versatile and easy-to-use social copy trading platform suite for web and mobile, eToro offers a large selection of cryptocurrency products, CFDs, shares, forex pairs, and a wide range of powerful trading tools. With licenses from multiple Tier-1 regulatory jurisdictions and a Trust Score rating of 90, we consider eToro to be a highly trusted broker. It's worth noting that eToro is not a discount broker (though it delivers more benefits than its competitors in the same price range). Trading forex and CFDs at eToro is slightly pricier than at many of its competitors, though the broker has recently lowered its spreads and introduced zero-dollar commissions for U.S. stock trading.

eToro Features

- Overall rating - 8.9/10

- Trust Score - 97

- Tradeable symbols - 7441

- Minimum deposit - $50-$10,000

Compare trading costs for the best Poland forex brokers

Based on our own data (our independent database contains over 4,000 data points), this table compares trading costs for the top Poland forex brokers.

| Company |

Accepts PL Residents |

Minimum Deposit |

Average spread (EUR/USD) - Standard account |

Average Spread EUR/USD - Mini |

All-in Cost EUR/USD - Active |

Active Trader or VIP Discounts [DELETED] |

FOREX.com FOREX.com

|

check |

$100 |

1.00 info |

1.4 info |

1.13 info |

|

XTB XTB

|

check |

$0 info |

0.92 info |

N/A |

0.92 info |

|

eToro eToro

|

check |

$50-$10,000 |

N/A |

N/A |

N/A |

|

Capital.com Capital.com

|

check |

$20 info |

0.64 info |

0.67 info |

0.67 info |

|

AvaTrade AvaTrade

|

check |

$100 |

0.93 info |

0.93 info |

0.61 info |

|

Comparing trading platforms between Poland forex brokers

Trading platforms grant access to the foreign exchange market and allow you to analyze market conditions, manage positions, and execute trades. Check out a side-by-side comparison of the trading platforms available at the best Poland forex brokers, based on our independent product testing.

Comparing investment options between Poland forex brokers

We closely monitor the availability of investment products such as forex trading (CFD and spot), stocks (CFD and non-CFD), spread betting, ETFs, and social copy trading – among many others. These investment types are tracked as variables within our extensive independent database. Check out the offering of investments at the top Poland forex brokers.

| Company |

Accepts PL Residents |

Forex Trading (Spot or CFDs) |

Spread Betting |

Copy Trading |

U.S. Stocks (CFDs) |

FOREX.com FOREX.com

|

check |

Yes |

No |

No |

Yes |

XTB XTB

|

check |

Yes |

No |

No |

Yes |

eToro eToro

|

check |

Yes |

No |

Yes |

Yes |

Capital.com Capital.com

|

check |

Yes |

Yes |

No |

Yes |

AvaTrade AvaTrade

|

check |

Yes |

Yes |

Yes |

Yes |

What is the best forex broker in Poland?

FOREX.com is our pick for the best forex broker in Poland. Founded in 1999, FOREX.com holds licenses across a number of notable global regulatory jurisdictions, and has earned an overall Trust Score rating of 99. FOREX.com's impressive offering of 5500 tradeable symbols opens up a wide variety of trading opportunities for its clients. If you are interested in opening an account, the minimum deposit to get started as a trader at FOREX.com is $100. We've tested and reviewed dozens of forex brokers and created unbiased, data-driven broker ratings to highlight the best forex brokers in the industry. Our overall rating for FOREX.com is 9.5/10. Read our data-driven broker reviews to learn more.

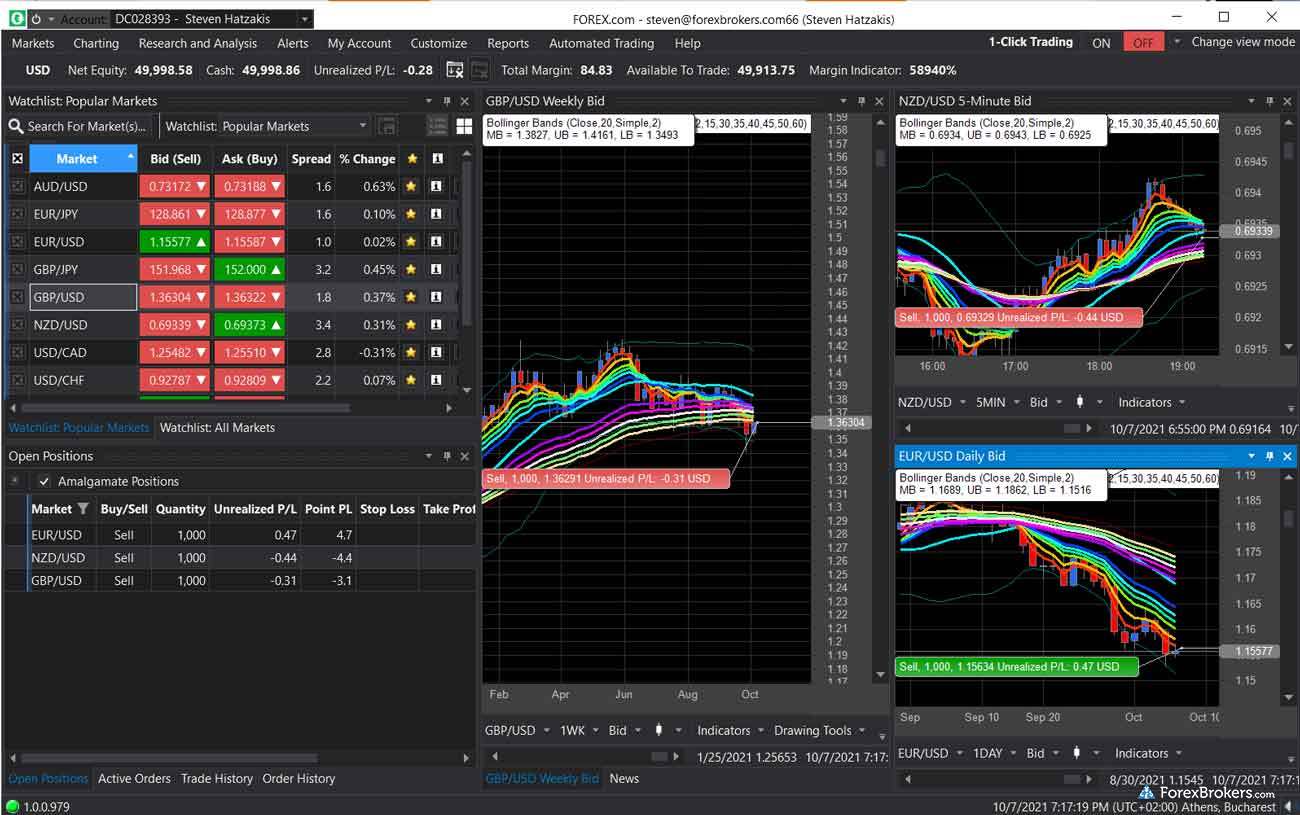

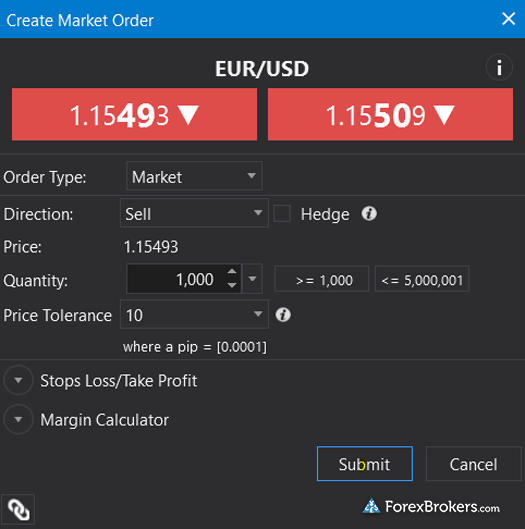

Check out a gallery of screenshots from FOREX.com's trading platforms, taken by our research team during our product testing.

Best Poland Forex Brokers

Here are our picks for the best forex brokers that accept Poland-based clients in 2025. The below table is sorted by the brokers' Overall Ratings.

Popular Forex Guides

More Forex Guides

Popular Forex Reviews

Methodology

At BrokerNotes.co, our data-driven online broker reviews are based on our extensive testing of brokers, platforms, products, technologies, and third-party trading tools. Our product testing extends to the quality and availability of educational content, market research resources, and the accessibility and capabilities of mobile platforms and trading apps. We also dive into each broker’s trading costs, such as VIP rebates, inactivity fees, custody fees, bid/ask spreads, and other fee-based data points.

Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go. We test mobile apps and products using iPhones running iOS 17 and Samsung devices running Android OS 14.

Note: The online brokers on our site provide the ability to trade forex in one or more ways, such as non-deliverable spot forex (i.e., rolling spot contracts), contracts for difference (CFD), or other derivatives such as futures. The availability of specific markets or features will depend on your country of residence and the broker's applicable brand or entity that services your account(s).

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Learn more about foreign exchange risk.

About the Editorial Team

Founded in 2014 and acquired in 2021, BrokerNotes.co provides unbiased forex broker reviews and ratings to help traders and investors find the best broker for their needs. With over 60 brokers reviewed, our editorial team has published thousands of words of research to help our readers make informed choices.

Steven Hatzakis is the Global Director of Online Broker Research for BrokerNotes.co and ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor (CTA).

Joey Shadeck is the Content Strategist and Research Analyst for BrokerNotes.co and ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content.

John Bringans is the Managing Editor of BrokerNotes.co and ForexBrokers.com. An experienced media professional, John has close to a decade of editorial experience with a background that includes key leadership roles at global newsroom outlets. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.